GST on late fees/ default fee/ Interest collected on delayed payment PLI/RPLI | Late Fee

GST on late fees/ default fee/ Interest collected on delayed payment PLI/RPLI | Late Fee

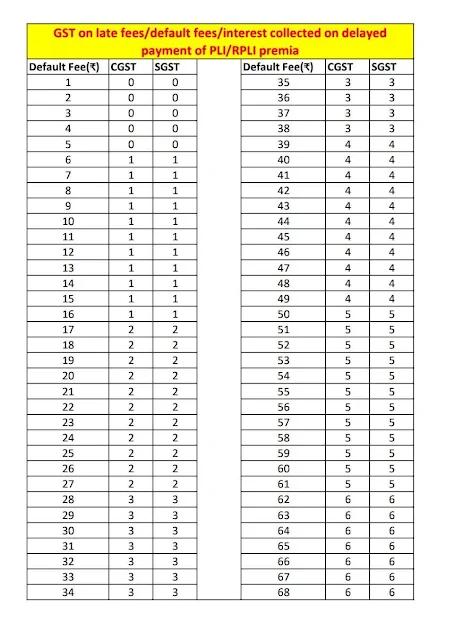

From 01.01.2024, GST is compulsorily payable on RPLI / PLI Default. Voucher should be posted in respective GL Code at Sub office. For the time being, the branch office should raise the balance by showing it to any other head. The circular will be circulated soon from the division office. Inform the sub office and branch office.

👉PLI D/F CGST---8866102730

👉PLI D/F SGST---8866102750

👉RPLI D/F CGST--8866102860

👉RPLI D/F SGST--8866102880

![IT Modernization Project 2012 and Updates MCQ:- MCQ on IT Modernization Project 2012 and Updates [IPO 2021]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi7eD-21TRwFFlBF0eRKjj99G9D1SJW2Vc7mHwbzoMVJDwjekV6IXlcZxwzbU_ZG-4Q5WgHjRNUrkl_jalsinJOxAAlZjchdXGi9RO8i1EDkkSIYJBgr3KUN9zj0nJUdIuQ0jrQaMWslYWh/s72-c/online-test-series.jpg)

![FR & SR and Financial Hand Book for IPO Examination [Online Test]-IPO2021](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgcp_wSYLoI1j137GQIf6WXaW7CaVIWml96tfINUIcenirpM1HqVJXJUUoCQwjTxiubiTYMYavQXjcH5mZAK5bqHGK2UY9tODpu0w2ItUGrVSbGEjFht-KGRxRAxivDZhtuMojm8qZ6gUTV/s72-w400-c-h170/online-test-series.jpg)

No comments

Leave a Reply: Your email address will not be published.